Nowadays, the aspect of finance management, banking, or any transaction that involves personal money can now be easily done with the use of an Internet connection. Through a mobile device or a desktop or laptop, anyone can gain access to their savings or checking accounts online to make purchases, transfer funds, or just check the amount of balance left in their accounts. In the realm of electronic commerce (or e-commerce), both buyers and sellers can take advantage of the Internet to make shopping even more reliable, without ever needing to go to a physical store. The same thing can be said for availing loans.

Whether you don’t have enough cash to survive the remaining days before your next paycheck, or you want to cover for the expenses of a certain event or a major purchase, availing loans is now possible online. Indeed, it has become a popular alternative to the typical loan establishment where people in need of cash usually go to register and borrow cash.

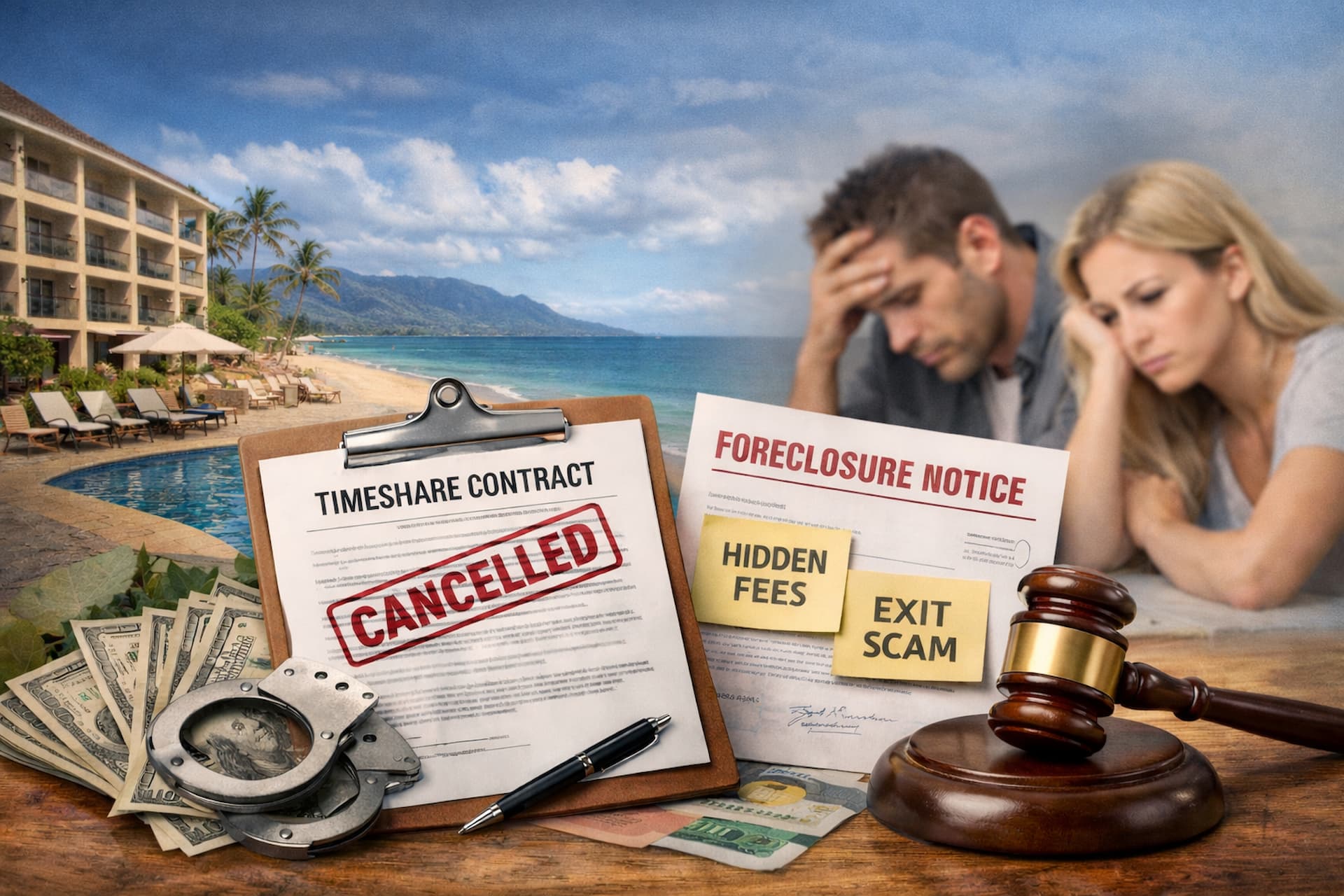

Today, anyone with an Internet connection can easily register and avail of personal loans without going to a bank, a lender or a credit union. In fact, anyone can do it in the comfort of their own homes. But while obtaining an online loan is a convenient way to borrow cash, any individual must still be wary of existing scammers lurking in the Internet. In fact, they conceal themselves as legitimate loan providers, waiting for potential customers they can victimize.

If you are planning to take out a loan via the Internet, it is best that you put into consideration these following tips:

- Take advantage of the fact that payday loans are easier and more convenient compared to the traditional venues for securing a loan, like a bank or a lender. It is definitely beneficial on your part to avail of an online loan since many online providers can get you qualified and approved immediately. When you go browse online, you will notice that they show their rates; use them to compare one from the other.

- Make sure to browse the best online loans out there with your wants or needs in mind. For instance, if you would like to go for low annual percentage rate or APR, then you need to look for loan providers that offer such. You can take advantage of other loan providers that have a low monthly payout, or those that can qualify you for a loan even if you have a low credit score. Make the effort to compare them accordingly until you decide on the best one.

- Do your part in making yourself aware of the ins and outs of payday loans. Indeed, you must make sure to read through articles about them. You can also take advantage of the loan calculators to compute for the loan rates of the online loan providers in your shortlist.

- You can go look for P2P (peer-to-peer) loan websites. Basically, peer-to-peer lending refers to the practice of lending money to people who are unrelated without the need to go through a bank, lender, or any financial institution. The loan amounts are usually smaller (i.e. microloans), but they are usually better than banks or credit cards when it comes to the payment terms, conditions, and rates.

- You can go to websites of the typical banks that you know. For sure, they provide information about their loans online. But for you to obtain more details about it, you may have to call them one by one or go through each of them personally.

- Make sure to be aware of bait-and-switch types of online loan providers. As much as possible, try to avoid them. Also, be diligent when it comes to protecting your privacy; if you are skeptical about a certain loan provider online, don’t give out or display pertinent financial information that you have such as your Social Security number or your bank account numbers.